6 Core Components of a Successful Digital Transformation in Banking

The process of digital transformation in banking is rather endless as systems, and new technologies appear and consistently evolve. But it is not-withstanding that the speed of that growth in upcoming years, following the 2021 post COVID era, will be many times faster.

Easier transactions and management, 24/7/365 services, superior convenience, and lots more are advantages of digital transformation in banking. However, a prosperous digital banking transformation is not simply about implementing innovative technology because digitalization is not guaranteed success. This is why studies show that 70 percent of complex, large-scale programs fail at their digitization goals.

In truth, a successful digital transformation in banking demands the right mindset, which includes transforming your approach to business, principles of product design and customer service, and the foundational culture of the organization with a sharp focus on your customer’s desires. Therefore, we discuss the key technologies, trends, and principles we must pay attention to develop the best digital banking solutions that guarantee long-term success.

1. Delivering the Authentic Customer Experience with UX

Banks must face the harsh reality that without creating a truly excellent customer experience, there are greater risks of losing even the most loyal customers. This is not about creating a glossy online banking solution but an actual application that understands and solves the needs of your ideal customers.

In the end, the winning solution is a well-designed user experience that makes your customers feel cared for and that they are eager to share their experience with their peers.

2. Focus on Transparency through Blockchain

Digital transactions also come with their own set of cybersecurity concerns. This is why distributed ledger technology is fast-moving beyond cryptocurrency to be used by financial services for everything from simplifying loan applications to smart contracts. Blockchain essentially decentralizes transactions and can remove mediators that often cause bottlenecks resulting in smoother transaction pipelines. Hence, Blockchain ensures a higher level of transparency and security and can facilitate collaboration.

3. Personalized Service through AI, Automation, and Cloud Computing

Cloud computing at the basics allows users – both banking staff and customers, to access particular financial services from any location. This enables remote work and transactions and aid banks reduce the overhead associated with on-premise data centers. Paired with automation and AI, firms can leverage data, analytics, and automated systems to respond to consumer inquiries with lower operational costs and increase accuracy, efficiency, and adherence to compliance issues.

Altogether, banking firms can leverage new heights of data to identify business opportunities, predict behaviors, assess risks, anticipate needs for loan defaults, and build wholesome and enriching connections with clients.

4. Endless Functionalities and Lightning-fast Services through Voice Tech and IoT.

With sensors, smartwatches, and other unique features brought by the internet of things (IoT), customers can enjoy banking through interconnected devices and contactless payments. Paired with voice technologies, thanks to the advent of digital assistants such as Alexa and Siri, customers can use their voices to perform inquiries and transactions.

5. Redefined Digital Operating Models

As said earlier, true digital transformation in banking also demands implementing an accurate digital operating model. Currently, these three key operating models are implemented by many financial institutions:

- Digital as Business as Usual – This model focuses on gradual improvement without changes to the management team. This model brings quick wins as benefits, but before long, siloed teams and legacy create complications.

- Digital as a New Line of Business – this model allows the firm to create a new business entity with a head of digital. This model is easier to buy and scale but might create complicated workflows. It also hands over the digital responsibility, alongside IT, into the hands of other business departments.

- Digital Native – This model allows the firm to create a new, digital-first bank with its technology stack, so there are no legacy systems to deal with. Such an entity will prioritize customer acquisition, new capabilities, and economies with immediate impact. The disadvantage is that the firm also needs to work harder to encourage existing customers to move to the new entity.

Even as all models have their unique challenges and benefits, it is possible to implement all three depending on the market, sector, and location.

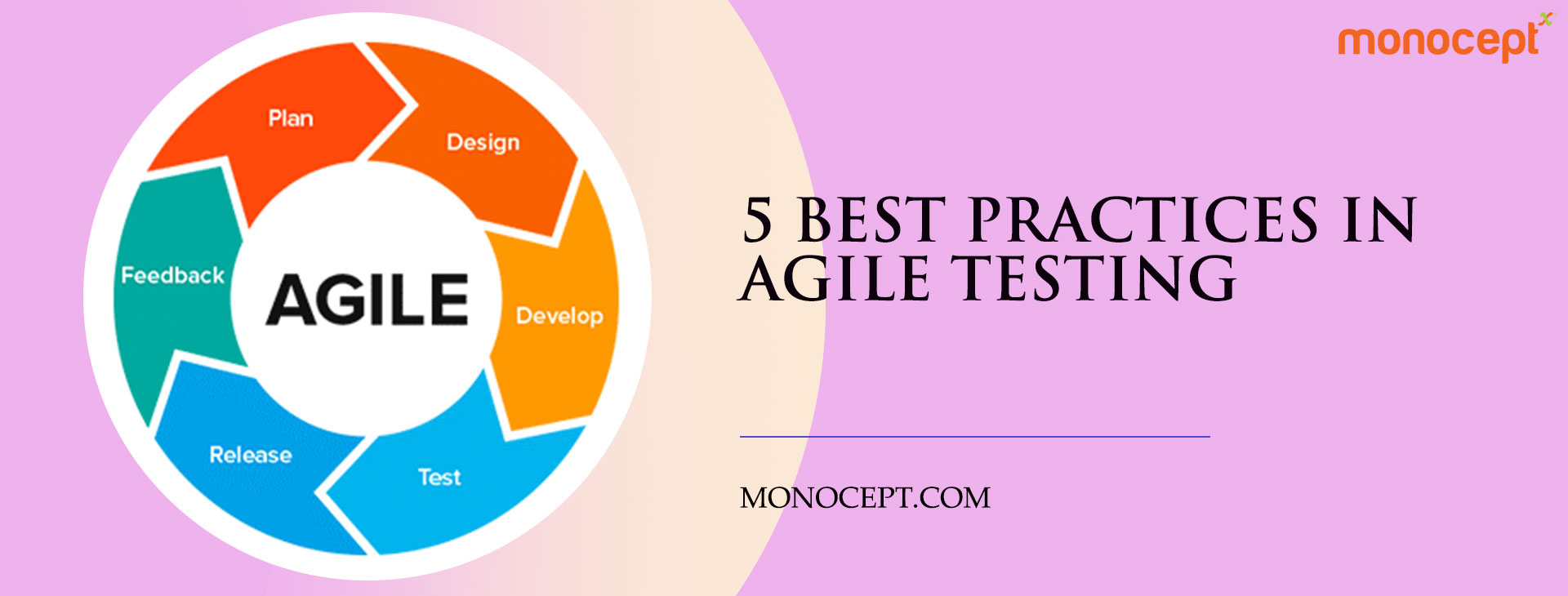

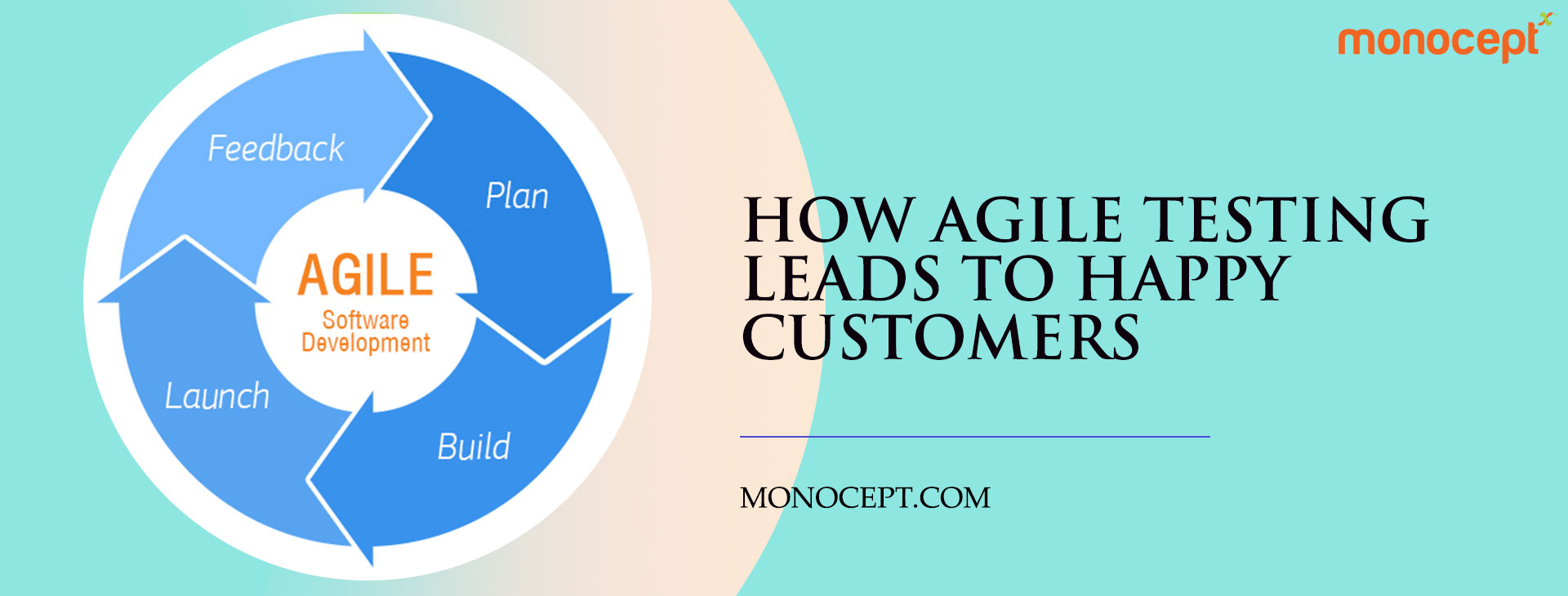

6. Modernized Infrastructure and Continuous Improvement with Innovative Digital-First Cultural Shifts

Besides the advent of innovative digital technologies, digital transformation in banking equally impacts infrastructure and entire work environments. With the help of agile, innovative pipeline strategies such as DevOps, alongside APIs and microservice architecture, banks can enjoy continuous integration and delivery, leading to faster release cycles and on-demand service delivery,

Concluding Thoughts

There is no doubt that digital transformation in banking is not without risks. However, a careful plan will prevent disruption to existing business processes and ensure proper innovations are integrated as safely and seamlessly as possible.

Digital transformation is disrupting the financial services industry. Banks are seeing their profit margins shrink and they’re looking for ways to grow revenue while reducing costs. That means banks will be turning to technology companies like Monocept for help with digital transformation in banking. We can help your bank get ahead of the curve by building a successful digital strategy that drives growth, improves customer experience, and reduces costs – all at once!