Why customer experiences matter

The world we live in, and the way we interact with products, services and business has changed completely, thanks to the explosion of technological advancements and innovations. Technology has opened up an unimaginable number of channels through which businesses can engage with us, while simultaneously exponentially increasing our expectations from them.

Across all sectors, businesses are feeling the heat and the burning need to digitally transform themselves to remain relevant to the audience of today. The insurance industry is not exempt from this tug of war. Modern consumers of insurance can no longer be satisfied with traditional insurance products and services. They demand personalised products and ease of interaction through digital interactions across platforms and devices. To be able to survive this changing business environment, insurers must be able to offer niche products, tailor-made to customers’ specific circumstances, while also ensuring that these products are easy to understand and access. All of this, while still maintaining a competitive advantage.

Needless to say, it is a constantly challenging and daunting task that insurers are faced with.

It is evident that the only way to succeed in such an aggressive and hyper-competitive industry is for businesses to shun traditional and outdated mindsets and rapidly adopt a digitised approach to deal with the changing market dynamics currently shaping the insurance industry. While on the one hand established insurers have the opportunity to understand and satisfy customers like never before by leveraging emerging digital technologies that offer sophisticated data analysis, customer experience management platforms and distribution systems, on the other, they are faced with an unprecedented level of competition from new players who are uniquely positioned to use the very same technologies to challenge them, thanks to their superior understanding of digital landscapes due to their digital native status.

Even as the insurance industry changes, with a complete overhaul of processes being undertaken across enterprises, the consumer too is changing. Today’s consumer has access to a lot of data, enabling them to compare prices of policies, while listening, in real time, what other customers or an organisation have to say about their products and services. Customers can verify claims, and make informed decisions based on collective consensus about which insurer is offering them the lowest prices, best after-sales services, hassle-free claims experience, and loyalty rewards. These new millennial customers are also not shy about sharing their own experiences with a business with potential customers, both online and offline.

For all these reasons, it has become imperative for insurers to offer long-term value to customers, while also keeping an eye on immediate benefits that can lure customers. What might be perceived as long term benefits, and what are the short-term inducements that can give one insurer an edge over the others, is something that can only be understood when insurers invest in building deeper, lasting and more fruitful relationships with customers.

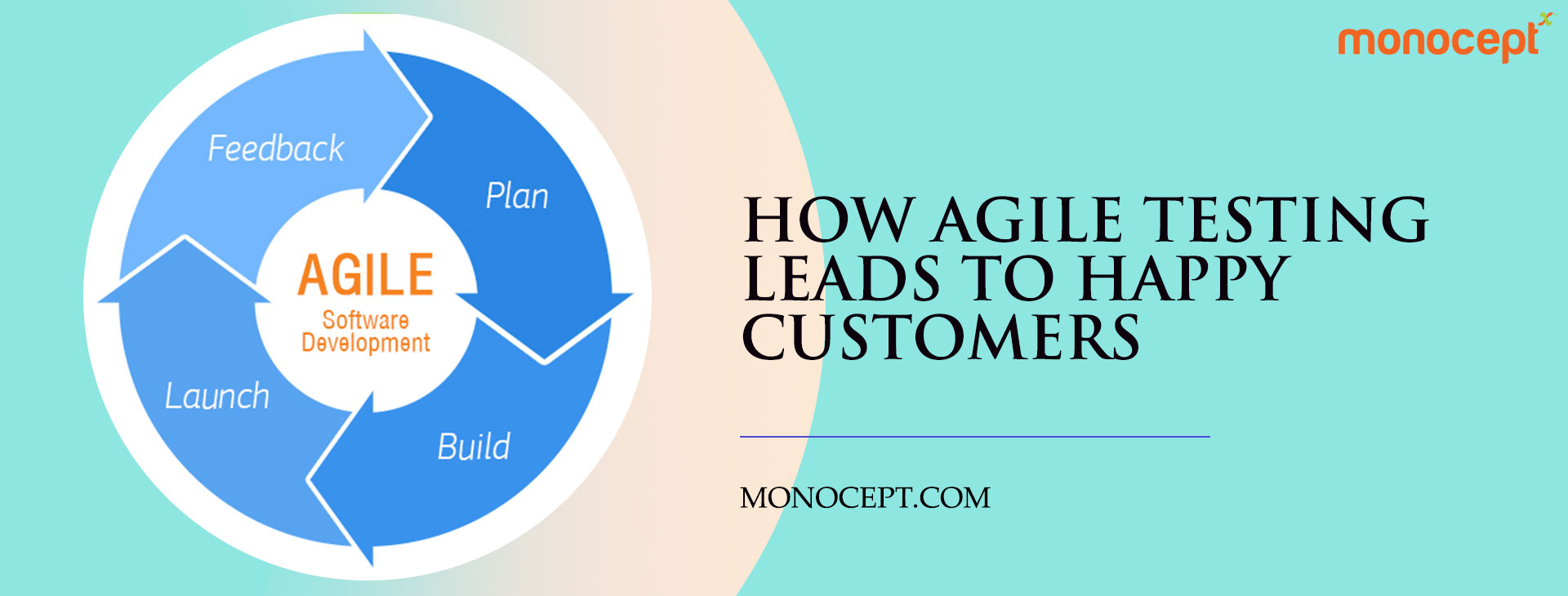

To make this happen, insurers need to undertake four tasks: wide-scale customer data collection and centralised storage; comprehensive analysis; invest in an integrated customer engagement management (CEM) system that allows insurance agents to instantly pull up relevant data regarding a query or issue instantly, helping them solve problems efficiently and providing the customer with the feeling for a valuable personalised interaction; and, finally, continuous innovation and experimentation to respond to evolving needs.

Whether an insurer is an established player or a new entrant in the market, and regardless of the size and scale of operations, convenience and consistency are the two ever-lasting pillars on which rests their strategy to impress potential customers and convert them into loyal, long-term business providers.

To know more drop a mail at info@monocept.com.