How Covid-19 is Accelerating Digital Insurance

The COVID-19 pandemic is impacting lives and businesses in diverse and previously unimaginable ways. Insurers are equally finding themselves at the center – from dealing with hundreds of questions about changing coverage needs and to paying an untold number of claims.

However, insurance companies are already designed to deal with dynamic changes as this, because risk analysis and crisis planning exist at their foundations. Hence, for the past five years, many insurance companies, like other business sectors, have been modernizing their systems to respond to their customers’ changing needs. From video onboarding, virtual claims processing, to no-touch automated underwriting, and electronic applications, many insurance firms were already on that path long before the COVID-19 era.

Nevertheless, the COVID-19 pandemic has made these modern adoptions faster than ever before, presenting the need for insurers to quickly modernize their systems to respond to the present realities. Still, due to their foundational processes, many insurance firms are already implementing strategies to weather the impacts of the current pandemic. However, there is equally a need to do it right. It is important to adapt business strategies not just to accommodate the present realities but prepare for the post-pandemic future and beyond.

What is Digital Insurance?

The concept of digital insurance is no longer a novelty as its core definition is fast changing to meet the present and future realities. Before, now Digital Insurance was just about using technology across certain products and some aspects of business operations. Now, it must encompass, majority, if not all, aspects of business operations and customer interactions. Today’s insurance marketplace may soon exist largely in the digital economy. Therefore, a conventional insurer must become a digital insurance company, as the COVID-19 era has made it more apparent for the need to leverage insights from the connections between insurance, health and wellness.

It is all about the customer.

Every insurer must realize that the right way to grasp the ongoing COVID-19 outbreak impacts fully is by assessing their people, systems, and ultimately, their customers. Therefore, the move from initially reacting to the pandemic to a longer-term strategy focuses on consumer behavior.

It is why, at Monocept, we believe that harnessing the customer-first approach is vital for any industry to navigate the uncertainties of the future.

Why?

From the present scenario, consumers’ demographic behavior has shifted as many consumers, who were not digital natives, are now behaving as though they are. Every consumer- young and old are now comfortable using smartphones, tablets and laptops for electronic transactions in general. They are more than ever eager to seek out innovative apps, ideas and experiences to make better life choices and work more effectively. For instance, PwC’s June Survey discovered that 37% of insurance consumers fear that the pandemic will impact on their financial future. Again 15% of the said participants also stated that they might purchase life insurance because of the COVID-19.

Therefore, insurers must realize that when they base their long-term business strategies on the customer-first approach, they can identify ways to meet their customers’ demands in unforeseen events. For instance, if they consider the lessons (insights) learned from the COVID-19 pandemic, they can create valuable features that can help their consumers protect themselves physically, emotionally and financially from future pandemics.

The Necessity of Digital Transformation in Insurance

Before the COVID-19, digital transformation was a line item on many businesses’ agendas, including insurance companies. Now, as the need to become a digital insurance provider becomes apparent, – business transformation is now a priority. It is now evident that investments in new technology cannot be delayed any longer. Survival today and achieving sustainable success tomorrow begins with strategic technology adoption.

Transformational strategies can help insurers sufficiently reconfigure existing products and services to integrate the new health and wellness ecosystems. It will equally help insurance firms flourish in an industry that is wholly moving towards virtual operations.

Still, when the world emerges from the pandemic’s horrors, there is no way the insurance industry can return to the traditional way of doing things. Siloed operations and policy-centric methodologies are no longer viable as the COVID-19 pandemic, and emerging technologies have reshaped the insurance environment’s general perceptions.

Where To Begin – Making Your Company Digitally Fit

Already, insurance companies have been able to adapt to the present crisis’s needs, from making investments in applications to embracing the remote workforce. No doubt that the present crisis accelerates the trend towards digitization and automation. Many insurance companies are forced to rely on virtual meetings, and operations and they now realize that the virtual world is indeed as productive, if not more. However, this move does not only increase efficiency but boosts revenue generation.

Therefore, embracing the concept of digital insurance in its truest forms saves time and money significantly, while reducing the possibilities of errors. It also ensures that insurance companies can rapidly expand their reach, build better customer relationships, and effectively prepare for the post-pandemic era.

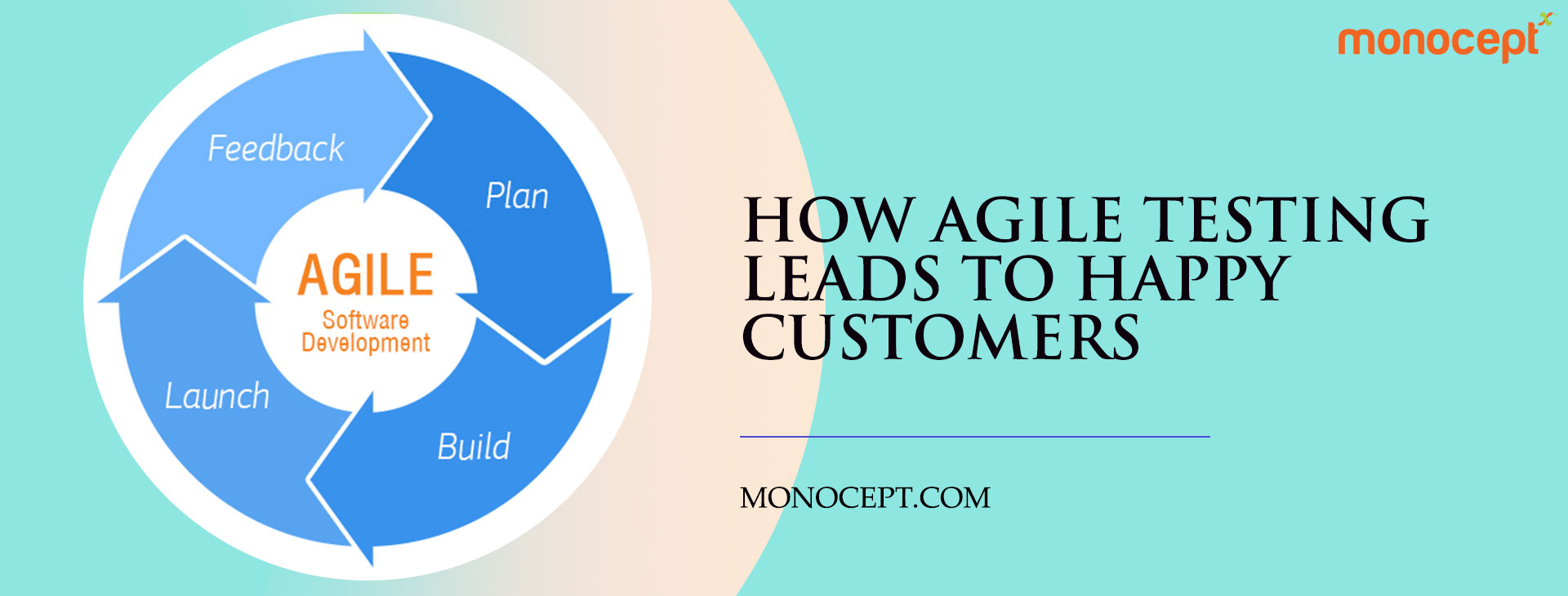

Nevertheless, adopting automation and remote work culture aren’t the only areas going to help insurers move ahead of competitors and enjoy higher and sustainable profits. Other vital areas to building an effective digital transformation road map include:

● AI-enabled Analytics

As said earlier, the customer is the driving force towards dealing with digital disruption and emerging technology innovations. Therefore, there is a need to harness data and analytics across entire value chains, including servicing, claims, operations, sales, and marketing. Advanced predictive analytics, fueled by AI, goes beyond conventional forecasting. It can help insurance companies deal with the unprecedented impacts of the crisis and prepare for other unforeseen crises in the future. The valuable insights from data can help insurance companies find meaningful connections to help navigate recoveries and future-proof their businesses.

● Cloud Infrastructure

As insurance companies embrace the “work-at-home” culture, gaps and vulnerabilities in operations become apparent. Already, dealing with the demands of clunky virtual private network connections and the risks of cyber-attacks have been a challenge for many years now. This further increases as the remote scene make these challenges greater. Therefore, insurance companies must move towards building cloud-centric business environments. Implementing cloud-based applications and infrastructure can help insurers augment their security capabilities, alongside maintaining and accelerating efficiency from the remote scene.

● Omnichannel Customer Journey

When demographics change, the customer’s buying journey changes as well. As the COVID-19 pandemic has enforced lockdowns and stay-at-home measures, adopting the online and omnichannel-enabled buying journey is also important. The omnichannel buying journey offers an exceptional and unique customer experience across physical, online, mobile and social channels.

Therefore, all stripes’ insurance companies must reinvent their customer service models based on interactions current and potential customers, alongside employees and distributors.

It is time to rethink what values we can bring to our customers and speed up and plan for the next wave of digitalization. However, always remember that creating authentic digital customer experiences require products to be first, intuitive, and easy, and second, simple enough for direct approvals, automated underwriting and re-applications to foster the type of instant gratification that customers expect today. Data and analytics off-course are important to augment products and refine core customer services to achieve a unified customer experience.

Adaptive workforce

As said earlier, whenever the pandemic becomes a thing of the past, returning to work will never be the same again. Insurers must realize that employees may not feel comfortable leading the perks of the digital ways of working. Therefore, insurers can only ensure their workforce’s efficiency and retain the best talents by providing relevant technological features and training. These are especially important for employees within delivery, services, and operations.

Concluding Thoughts

Preparations for the post-pandemic era begins now. The COVID-19 is a reminder, not only about the wonders of life but about the need to prepare for unforeseen circumstances. Therefore, insurers must not just strive to effectively manage the present crisis but be prepared for whatever happens next. This is not just about developing a hot new insurance package or process, but also adopting a holistic approach to accomplish the true customer focus across the entire organization. Still, every insurance firm is different, and a digital transformation is never an event but an ongoing process. Therefore, it will be an enormous error to see digital transformation as a finite set of features or capabilities needed to adopt the concept of digital insurance. An authentic transformational journey begins by reinventing the basic value proposition of any insurance firm. Therefore, it does not focus on reengineering internal operations or embracing new technologies to manage risks. Instead, it is about wholly using the customer-centric approach to attain sustainable success.

Overall, today’s insurers win and retain customers by implementing the right tools, partners, and mindset to meet digital transformation hurdles. It is the right way to ensure long-term growth and sustainable success.

What’s your Challenge? Let’s work together to solve it.