The Transformative Power of Generative AI in the Insurance Industry

The Transformative Power of Generative AI in the Insurance Industry

In the next five years, generative AI could fundamentally reshape the insurance industry’s approach to risk management, compliance, and customer interaction by automating, accelerating, and enhancing processes ranging from policy underwriting to claims processing and fraud detection.

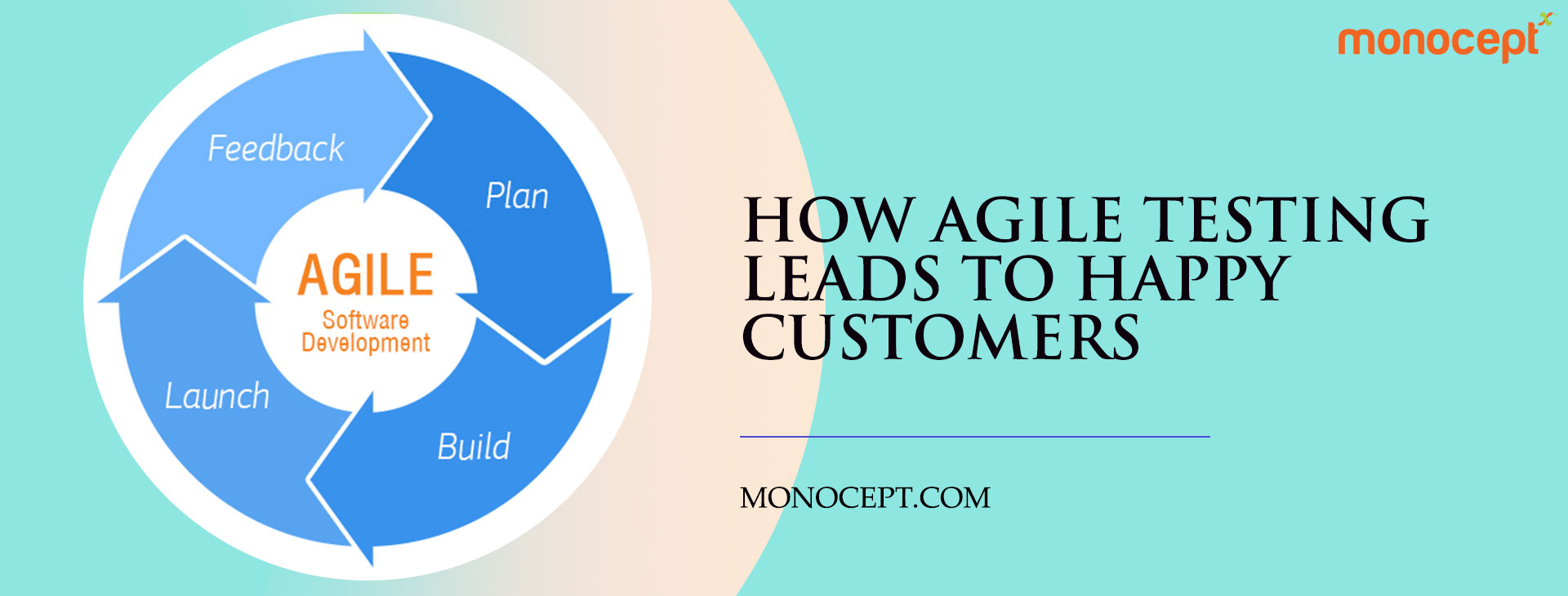

Generative AI is on the brink of becoming a pivotal force for innovation and productivity gains across various sectors, with the insurance industry poised to reap significant benefits. The technology is set to revolutionise insurance operations, from streamlining complex underwriting models to customer KYC to automating routine tasks and extracting insights from unstructured data. It promises to transform how insurers and their partners onboard customers, assess risks, comply with evolving regulations, and engage with customers.

For risk management and compliance departments within insurance companies, it’s crucial to establish robust frameworks governing the deployment of gen AI. Yet, this technology can significantly boost these functions’ efficiency and efficacy. This article explores how insurers can develop a dynamic and effective strategy for leveraging gen AI in risk management and compliance, highlighting essential considerations for industry leaders.

Embracing the Potential of Gen AI in Insurance

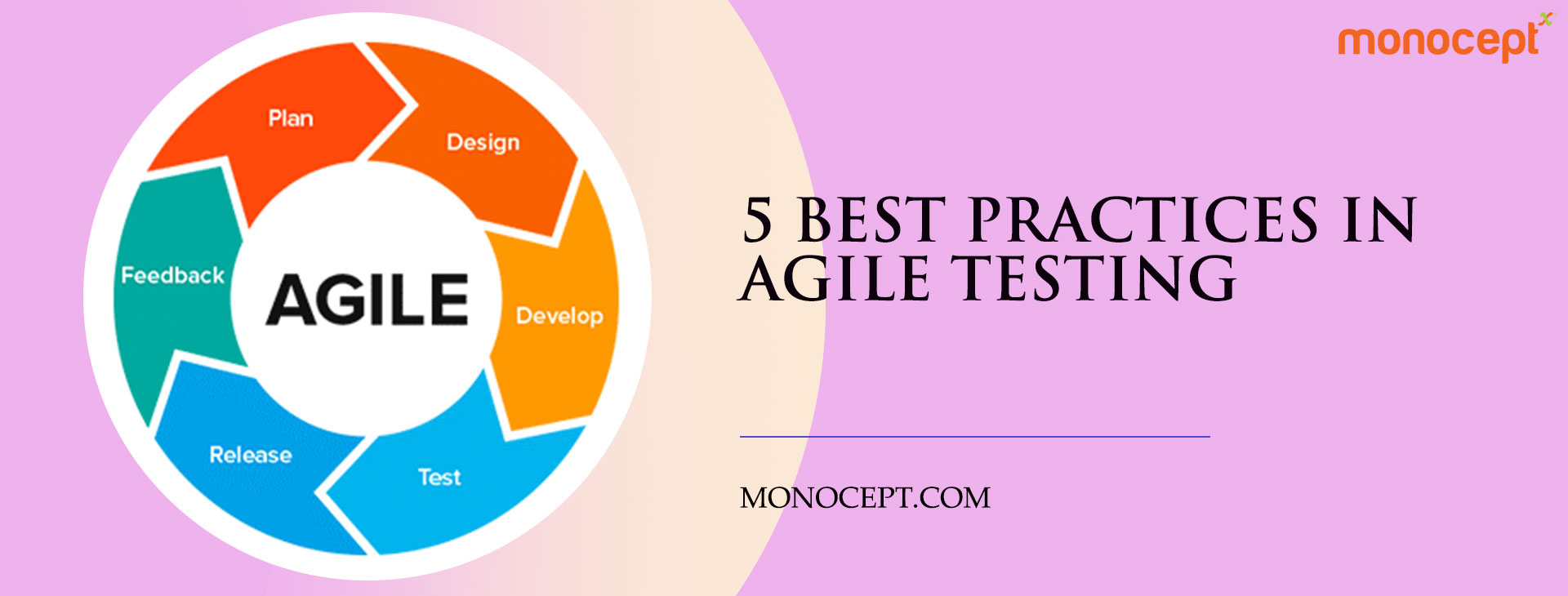

Generative AI has the potential to dramatically alter how insurers manage risk and compliance in the coming years. It enables a transition from task-based activities to a more strategic partnership with business units, focusing on proactive risk mitigation from the onset of new customer engagements—a concept often described as “shift left.” This shift can liberate risk management professionals to focus more on advising on product development, strategic decision-making, exploring new risk trends, bolstering resilience, and proactively improving risk assessment and control processes.

Innovative Applications of Gen AI in Insurance

For the insurance industry, the promising applications of gen AI span across several critical functions:

- Underwriting and Risk Assessment: Gen AI can enhance underwriting precision by analyzing vast data sets, including external data like climate risks or social media behaviour, to assess policyholder risk profiles better.

- Claims Processing: Automating claims analysis can expedite settlements, reduce errors, and detect fraudulent claims, improving customer satisfaction and operational efficiency.

- Customer Service: Virtual assistants powered by Gen AI can provide personalized, accurate, and instant responses to customer inquiries, elevating the customer experience.

- Regulatory Compliance: Insurers can leverage Gen AI to stay abreast of changing regulations, automate compliance checks, and ensure policies and procedures are up-to-date, mitigating the risk of non-compliance penalties.

- Fraud Detection: By analyzing patterns and identifying anomalies in claims data, gen AI can significantly enhance insurers’ ability to detect and prevent fraud.

Critical Considerations for Gen AI Adoption in Insurance

Implementing gen AI in the insurance sector requires careful consideration of several factors to ensure effective and responsible utilization. Insurers must prioritize use cases based on impact, risk, and feasibility, considering their strategic goals, regulatory landscape, and data sensitivity issues. It’s also vital to be cognizant of the new risks gen AI introduces, such as bias, privacy concerns, and security vulnerabilities, and develop strategies to mitigate them effectively.

Conclusion

As the insurance industry stands on the cusp of a generative AI revolution, insurers that harness this technology’s capabilities while adeptly managing its risks can achieve unparalleled efficiency, innovation, and competitive advantage. By embedding gen AI into their operations, insurance companies can streamline their processes and offer more personalized and responsive services to their customers, setting new standards in the industry.